Embark on a comprehensive journey into the world of finance with the FIN 320 2-1 MyFinancelab assignment. This meticulously crafted assignment provides a comprehensive overview of essential financial concepts, theories, and their practical applications, equipping you with the knowledge and skills to make informed financial decisions.

Throughout this assignment, you will delve into the intricacies of financial analysis, investment management, capital budgeting, and financing. Case studies and real-world examples will bring these concepts to life, demonstrating their significance in the business world.

Course Overview: Fin 320 2-1 Myfinancelab Assignment

FIN 320 2-1 is an introductory course to financial management. The course provides students with the fundamental principles and tools of financial management, with a focus on the practical application of these principles to real-world business situations.

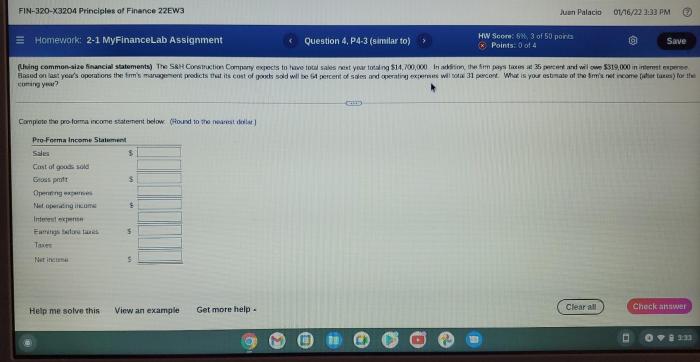

The course is divided into three main modules: Financial Statement Analysis, Capital Budgeting, and Capital Structure. The first module introduces students to the basics of financial statement analysis, including how to read and interpret financial statements, and how to use financial ratios to assess a company’s financial health.

Module 1: Financial Statement Analysis

- Introduction to financial statement analysis

- Balance sheet

- Income statement

- Statement of cash flows

- Financial ratios

The second module covers capital budgeting, which is the process of evaluating and selecting long-term investment projects. Students will learn how to use various capital budgeting techniques, such as the net present value (NPV) and internal rate of return (IRR), to evaluate the profitability of investment projects.

Module 2: Capital Budgeting

- Introduction to capital budgeting

- Capital budgeting techniques

- Risk analysis

- Project evaluation

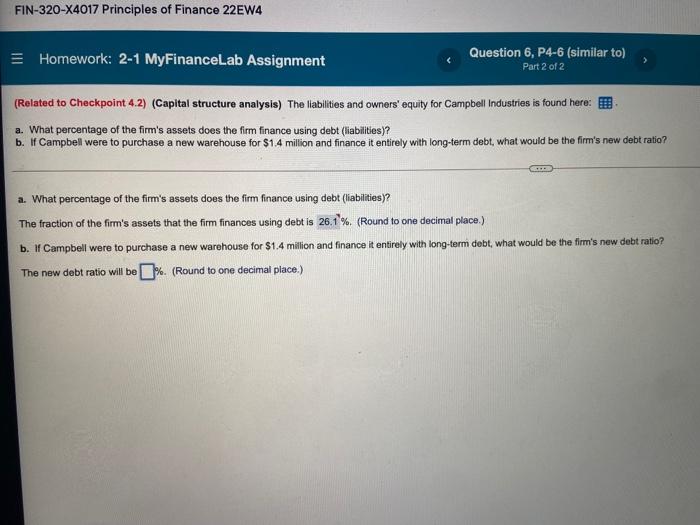

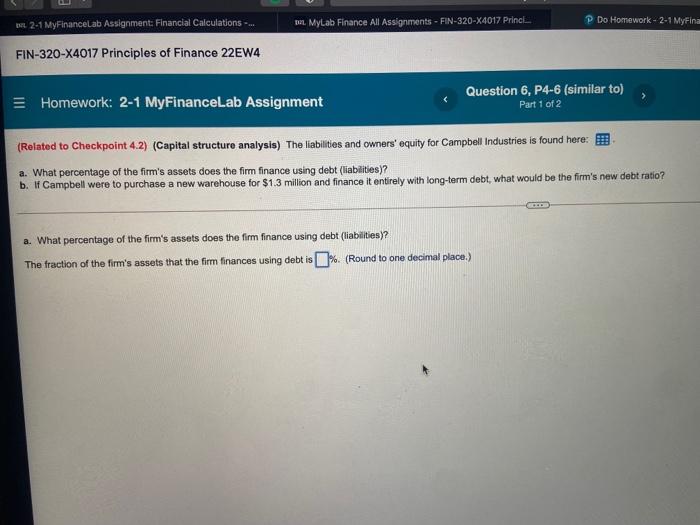

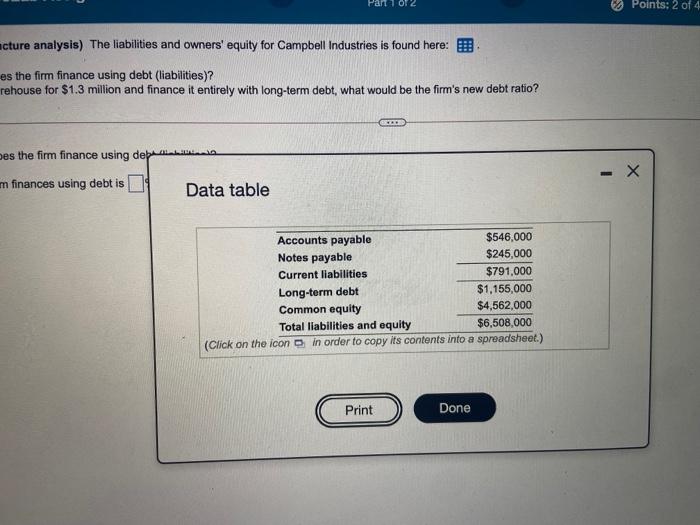

The third module focuses on capital structure, which is the mix of debt and equity financing that a company uses to finance its operations. Students will learn how to use various capital structure theories to determine the optimal capital structure for a company.

Module 3: Capital Structure

- Introduction to capital structure

- Capital structure theories

- Cost of capital

- Capital structure decisions

MyFinancelab Assignment

The MyFinancelab assignment is an online interactive tool that provides students with a comprehensive and engaging learning experience in finance. It offers a variety of interactive exercises, simulations, and assessments designed to reinforce the concepts covered in the course.

The assignment consists of several modules, each focusing on a specific topic within finance. Students are required to complete a series of tasks within each module, including:

Tasks and Requirements

- Interactive exercises: These exercises allow students to apply their knowledge of financial concepts through interactive simulations and problem-solving activities.

- Simulations: Simulations provide students with real-world scenarios where they can make financial decisions and observe the consequences of their choices.

- Assessments: Assessments evaluate students’ understanding of the material covered in each module and provide feedback on their progress.

Financial Concepts and Theories

Financial concepts and theories provide a framework for understanding how financial markets operate and how financial decisions are made. These concepts and theories are essential for individuals and organizations to make informed financial decisions and achieve their financial goals.In this course, we will explore key financial concepts and theories, including time value of money, risk and return, capital budgeting, and portfolio management.

We will also examine how these concepts and theories are applied in practice by financial professionals.

Time Value of Money

The time value of money (TVM) is a fundamental concept in finance that recognizes the fact that money today is worth more than money in the future. This is because money today can be invested and earn interest, which increases its value over time.

The TVM is used to calculate the present value and future value of cash flows, which is essential for making investment decisions.

Risk and Return, Fin 320 2-1 myfinancelab assignment

Risk and return are two key concepts in finance that are closely related. Risk refers to the uncertainty of an investment’s outcome, while return refers to the profit or loss that an investment generates. In general, higher-risk investments have the potential to generate higher returns, while lower-risk investments have the potential to generate lower returns.

Investors must carefully consider their risk tolerance and investment goals when making investment decisions.

Capital Budgeting

Capital budgeting is the process of evaluating and selecting long-term investment projects. Capital budgeting decisions are critical for organizations because they can have a significant impact on the organization’s future financial performance. The capital budgeting process involves identifying potential investment projects, evaluating the projects’ costs and benefits, and selecting the projects that are expected to generate the highest returns.

Portfolio Management

Portfolio management is the process of managing a group of investments. The goal of portfolio management is to create a portfolio that meets the investor’s risk tolerance and investment goals. Portfolio managers use a variety of investment strategies to achieve their desired results, such as diversification, asset allocation, and rebalancing.

Financial Analysis and Decision-Making

Financial analysis is the process of evaluating a company’s financial performance and position to make informed financial decisions. It involves examining financial statements, conducting ratio analysis, and using other financial tools to assess the company’s financial health, profitability, and risk.

Financial analysis is essential for making sound financial decisions, such as investment decisions, lending decisions, and budgeting decisions. It helps investors evaluate the risk and return of potential investments, lenders assess the creditworthiness of borrowers, and managers allocate resources effectively.

Methods of Financial Analysis

There are various methods used for financial analysis, including:

- Ratio analysis:Involves calculating financial ratios to assess a company’s liquidity, solvency, profitability, and efficiency.

- Trend analysis:Examines changes in financial data over time to identify trends and patterns.

- Cash flow analysis:Analyzes the flow of cash into and out of a company to assess its liquidity and financial flexibility.

- Discounted cash flow analysis:Used to estimate the present value of future cash flows to evaluate the profitability of an investment.

Examples of Financial Analysis

Financial analysis is used in various situations to make informed financial decisions, such as:

- Investment decisions:Investors use financial analysis to evaluate the risk and return of potential investments and make informed investment decisions.

- Lending decisions:Lenders use financial analysis to assess the creditworthiness of borrowers and determine the likelihood of repayment.

- Budgeting decisions:Managers use financial analysis to allocate resources effectively and make informed budgeting decisions.

Investment and Portfolio Management

Investment and portfolio management involve the allocation of financial resources to achieve specific financial goals. The principles guiding these processes include diversification, risk management, and return optimization.

Various types of investments exist, each with its own risk-return profile. Common categories include stocks, bonds, mutual funds, and real estate. Stocks represent ownership in a company and offer the potential for high returns but also carry higher risk. Bonds are loans made to companies or governments and provide fixed income payments but typically have lower returns and lower risk than stocks.

Mutual funds are professionally managed portfolios that invest in a diversified mix of assets, offering investors a balanced approach with varying levels of risk and return. Real estate involves investing in land and buildings, offering potential for appreciation and rental income but also carrying risks such as illiquidity and market fluctuations.

Capital Budgeting and Financing

Capital budgeting is the process of evaluating and selecting long-term investments. It involves estimating the cash flows associated with a project and determining whether the project is financially viable.

There are several methods used to evaluate investment projects, including:

- Net present value (NPV): This method calculates the present value of the future cash flows of a project and subtracts the initial investment cost. A project with a positive NPV is considered financially viable.

- Internal rate of return (IRR): This method calculates the discount rate that makes the NPV of a project equal to zero. A project with an IRR greater than the cost of capital is considered financially viable.

- Payback period: This method calculates the number of years it takes for a project to generate enough cash flow to cover the initial investment cost. A project with a short payback period is considered less risky than a project with a long payback period.

Once a project has been evaluated and selected, a business must decide how to finance the project. There are several sources of financing available to businesses, including:

- Debt financing: This involves borrowing money from a bank or other financial institution. Debt financing is typically less expensive than equity financing, but it also comes with more risk.

- Equity financing: This involves selling shares of stock in the business. Equity financing is typically more expensive than debt financing, but it also comes with less risk.

- Hybrid financing: This involves a combination of debt and equity financing. Hybrid financing can be tailored to meet the specific needs of a business.

The choice of financing source will depend on a number of factors, including the size and nature of the project, the financial condition of the business, and the cost of capital.

Case Studies and Real-World Applications

Financial concepts and theories are not merely abstract ideas but have practical implications in the real world. Case studies and real-world examples provide invaluable insights into how financial analysis and decision-making are applied in various contexts.

Case studies offer detailed examinations of specific companies or situations, allowing students to witness the application of financial principles in practice. These studies highlight the challenges and opportunities faced by businesses and demonstrate how financial analysis can inform decision-making.

Examples of Case Studies

- Analyzing the financial performance of a publicly traded company to identify potential investment opportunities.

- Evaluating the impact of a merger or acquisition on the combined entity’s financial health.

- Assessing the financial viability of a start-up company seeking funding.

Real-world examples, on the other hand, provide concrete illustrations of financial concepts and theories in action. These examples can be drawn from news articles, corporate reports, or industry case studies.

Examples of Real-World Applications

- Using financial ratios to compare the performance of competing companies.

- Applying discounted cash flow analysis to evaluate the potential return on a capital investment.

- Conducting sensitivity analysis to assess the impact of changing economic conditions on a company’s financial projections.

By incorporating case studies and real-world examples into financial education, students gain a deeper understanding of the practical applications of financial concepts and theories. This knowledge prepares them to make informed financial decisions in their personal and professional lives.

FAQ Corner

What is the purpose of the FIN 320 2-1 MyFinancelab assignment?

The FIN 320 2-1 MyFinancelab assignment is designed to provide students with a comprehensive understanding of fundamental financial concepts and their practical applications.

What are the key topics covered in the assignment?

The assignment covers a wide range of topics, including financial analysis, investment management, capital budgeting, financing, and financial concepts and theories.

How will I benefit from completing this assignment?

Completing this assignment will enhance your financial literacy, equipping you with the knowledge and skills to make informed financial decisions.